Elections and Volumes 2017

Ignore the rubbish spouted about the ‘election effect’ on housing volumes, these are the facts – and what I believe will happen next.

There’s a lot of nonsense talked about how elections affect the housing market with a whole variety of claims published across social media and even the national press, most of which aren’t supported by the facts. The Daily Mail printed a story just this week claiming election campaigns dent transactions. It’s complete tosh – and here are the numbers that will prove how the prospect of political change really affects consumer confidence and the buying decision.

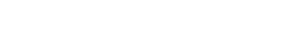

I’ve compared the volume of residential sales from the time the election is announced up to a point two months after (the average amount of time it takes to reach legal completion after an offer is accepted). To discount the possible retort of “the spring market always works this way”, I plotted the volumes for every year since 2005 (when much more accurate figures from the HMRC based on Stamp Duty Land Tax were introduced) on a single chart. It demonstrates how seasonality has largely been eradicated from the UK market over the last decade.

The jumble of spaghetti on the chart below shows volumes since 2005 (I’ve highlighted the election years) and the difference between the years is startling. In 2005 for example, an election year, there were more transactions in December than any other month in the year and it was the same in 2009, with November 2013 pushing December into second place with, of all months, August a close third! The world has clearly changed.

However, one thing that the new asymmetrical pattern of the market has brought is the opportunity to spot trends and patterns, and none has been clearer than how home-buyers behave over the election period.

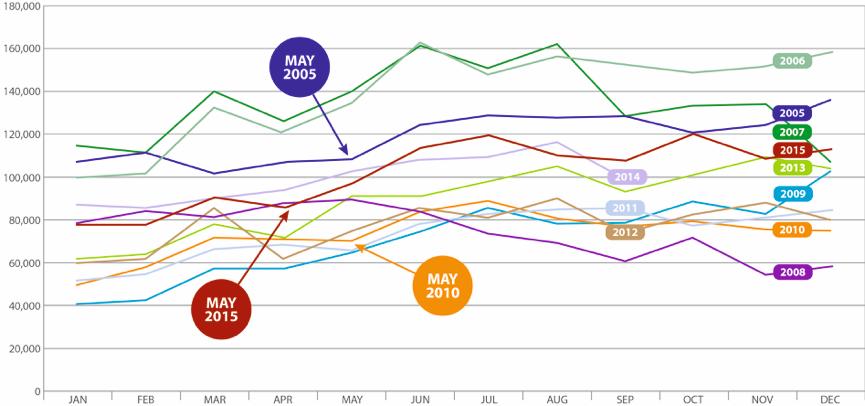

If we take the ‘spaghetti’ chart and remove every year except the election years the relationship between the volumes going into and coming out of the election period start to become clear. And then when we highlight two months before and two months after the election itself, the data presents a compelling argument indicating there is a very clear pattern of behaviour emerging.

There are some important factors to consider here. In all three election years since 2005, the market was in a very different place. In 2005, volumes were high, at an average of over 100K per month, whereas during post-recession 2010, volumes averaged around 65K and 2015 saw volumes running around the 80K mark. In 05 the market was cooling as we approached the election period and conversely the market was moving ahead in 2010, as it was in 2015. And the result of the election was different on all three occasions too. Labour won under Tony Blair in 2005, we had a coalition government in 2010 and David Cameron’s Conservative government was elected 5 years later.

Despite different volumes, market conditions and election results, the market behaved in the same way. For the two months prior to polling day, volumes were steady at the levels they were when the hustings began, then, immediately after the election itself, volumes climbed steeply, even though a different colour government was elected on each occasion.

It’s very important to remember that these figures refer to legal completions, so the sales will have been agreed 6 to 8 weeks before.

So, far from the election denting transaction numbers as the Daily Mail’s “experts” would have us believe, the number of sales agreed increase substantially during the run up to the poll. The data suggest that consumers conclude that a new government might mess with key factors influencing their decision to buy; Stamp Duty, interest rates or, for buyers of new homes, Help To Buy, so they think ’buy now before the game changes’.

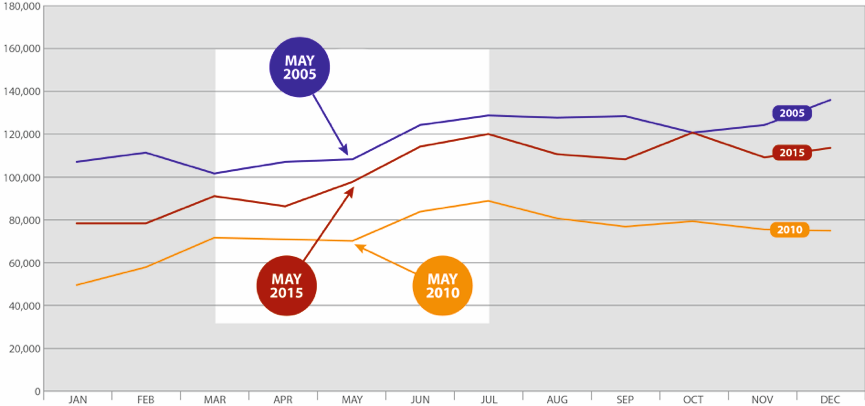

I believe these data provide the clearest possible guide to the way the market will react in the month before this snap election and two months afterwards, although the uptick might be slightly weighted towards the end of the period because of the short notice given to voters. Other than that, I see no reason why the effect of this election should be any different from the last three, Brexit or no Brexit.

On the chart below I have plotted what I believe the effect will be this year. This election is a month later than the previous three, but I am confident the pattern will still be replicated. Although there was a dramatic and largely unexpected upturn in transactions in March, I still firmly believe that overall transaction volumes will be lower in 2017 than in 2016, so the election effect will be slightly less extreme, but I am confident it will happen. Those thinking of buying over the next few months will want the certainty of a done deal and fixed interest rates.

I know that everyone believes the Conservatives will be a shoo-in, but elections can bring shocks and surprises – just ask Hillary Clinton or the ‘UK Remainers’. Before the election was announced, John Healy, the Shadow Minister for Housing, spooked the builders at the HBF Policy Conference in March by insisting that, if Labour was elected, Help To Buy would be high on their hit list, he suggested that people earning over, ‘say £70,000’ (he wasn’t able to be specific) would be disqualified from the scheme. He also plans to limit the scheme to first time buyers only. He announced this policy again the following day on Radio 4. For potential buyers of new homes, it’s surely a case of act now, just in case. If, by some strange twist of fate and the fickle nature of politics, a Labour government is returned, many of those planning to buy, new or second-hand, will find the means to that end cruelly dashed from their grasp.

Given the reduction in overall volumes this year, I believe the consequent effect on prices will be minimal. We are operating in a steadier, more stable market than any I have experienced in over 30 years in the business, and I don’t see that changing anytime soon. The ‘snap’ nature of this election has left time very short to take action on the run-in, but for the developers’ sales staff and the estate agents the opportunity is writ large – they should be saying to their prospective buyers “buy now and be certain”, it would work for me!

Author Notes:

Matt Fleming is the founder of Aylesworth Fleming Limited, the UK’s biggest residential specialist advertising agency established in 1985. He has spent over 30 years specialising in the housing market and his agency has acted for most of the UK’s top ten developers down the years.